Young and Jobless | The Economist - The ratio of youth to adult unemployment worsens

Democracy in America: Wall Street drinks our milkhake | The Economist

Saturday, December 18, 2010

Wednesday, December 8, 2010

Am I Missing Something Here?

This whole tax cuts thing has got me up in arms.

Here's how I view the back and forth of Congress about the tax cuts, I was so peeved, I had to reach out to my friend Shawn (who is a political genius) just to make sure I was understanding everything correctly...

The GOP (who control NEITHER the House nor the Senate) stone walled Obama with a Filibuster. Basically they pinned Obama into a corner by arguing, arguing, arguing. Obama wanted to keep the tax cuts for everyone making less than 250K (which is about 95% of the country) but that wasn’t good enough for the GOP so they do what they do best – argue, argue, argue.

And here’s the problem from Obama’s point of view – tax cuts will end, for EVERYONE, by the end of the year. So arguing gets nothing done. The GOP knows this. They also know that “raising” taxes (letting the tax cuts expire) in the middle of a recession, when the American people need more money now more than ever, would be Presidential suicide. So they put Obama in a sensitive situation;

either…

So it seems Obama was in a Prisoner’s Dilemma. He was damned if he do and damned if he don’t. And now certain members of the Democratic Party dislike how Obama conceded (compromised) with the Republicans. These people are idiots. The Republican plan was simple and brilliant at the same time:

Shawn agreed and added that Republicans clearly had the upper-hand here and Obama could only play this card. But there's an underlying issue here; when are we, as Americans, going to demand more of our politicians? We need a call to action. We need people that can get things DONE. Arguing solves nothing.

It's time we stop the bickering and remember what we are here for and that's to make America a better place, NOT play political strategist and stone wall the President (which in my mind is a political Coup d'etat).

The New York Times had an article about this today, you can read it here.

Here's how I view the back and forth of Congress about the tax cuts, I was so peeved, I had to reach out to my friend Shawn (who is a political genius) just to make sure I was understanding everything correctly...

The GOP (who control NEITHER the House nor the Senate) stone walled Obama with a Filibuster. Basically they pinned Obama into a corner by arguing, arguing, arguing. Obama wanted to keep the tax cuts for everyone making less than 250K (which is about 95% of the country) but that wasn’t good enough for the GOP so they do what they do best – argue, argue, argue.

And here’s the problem from Obama’s point of view – tax cuts will end, for EVERYONE, by the end of the year. So arguing gets nothing done. The GOP knows this. They also know that “raising” taxes (letting the tax cuts expire) in the middle of a recession, when the American people need more money now more than ever, would be Presidential suicide. So they put Obama in a sensitive situation;

either…

- A - Argue until congress breaks for the holidays with no plan in place and let the tax cuts expire for everyone (keep in mind we would be going back to our original tax rates…which in some way is a hike in taxes…but all in all what we should’ve been paying all along) in the MIDDLE OF A RECESSION!!!

- B - Concede to the GOP demands and extend the tax cuts for everyone (wealthy and non-wealthy) for two years (they will expire during an election…hmmm the irony).

So it seems Obama was in a Prisoner’s Dilemma. He was damned if he do and damned if he don’t. And now certain members of the Democratic Party dislike how Obama conceded (compromised) with the Republicans. These people are idiots. The Republican plan was simple and brilliant at the same time:

- Whine like a baby to get their wishes

- Back Obama into a corner until he concedes

- Watch from afar as the Democratic Party pick on Obama

- Build on this internal strife on the next election

- Use taxes and government spending as a cornerstone for the next election period

- Overturn congress (and possibly the White House)

- Rinse, lather, repeat…

Shawn agreed and added that Republicans clearly had the upper-hand here and Obama could only play this card. But there's an underlying issue here; when are we, as Americans, going to demand more of our politicians? We need a call to action. We need people that can get things DONE. Arguing solves nothing.

It's time we stop the bickering and remember what we are here for and that's to make America a better place, NOT play political strategist and stone wall the President (which in my mind is a political Coup d'etat).

The New York Times had an article about this today, you can read it here.

Labels:

Barack Obama,

Congress,

Democrats,

Filibuster,

GOP,

Recession,

Republicans,

Tax Cuts,

This is AMERICA DAMNIT

Monday, November 29, 2010

Antoine Walker and Bad Money Management

This video will show you how to blow through $110 million dollars.

Labels:

Antoine Walker,

Chicago,

Michael Jordan

Wednesday, November 24, 2010

The Fed and Quantitative Easing: Necessity and Risks

I noticed that Patty Hirsch's video of Quantitative Easing has 73,000+ views. Brad and I have had some discussions about QE2 (the second round of Quantitative Easing) and I talked to another economist friend of mine (we'll call him Shawn) who was kind enough to write some thoughts about QE. I have posted below...

The Problem:

The U.S. economy is currently sputtering along, hovering at high unemployment (almost 10%), and facing a possible risk of deflation. Core inflation (which excludes volatile food and energy prices) is currently at .06 percent, the lowest ever on record.

The Fed’s Solution:

The Fed will purchase $600 billion worth of U.S. Treasury bonds (2 year/10 year/30 year bonds) over the following months, adjusting the amount after each set of purchases according to the economic response.

Why?

The Fed’s main goal right now is to invigorate the economy, but its intention is hampered by investors who park their capital in U.S. Treasury bonds instead of investing it in riskier assets like stocks.

To incentivize these players to move their money into stocks, the Fed must reduce the appeal of U.S. Treasury bonds.

Their Plan:

Buy billions of dollars worth of U.S. Treasury bonds → Lowers the U.S. Treasury bonds’ interest rates → Creates less demand for these bonds → Greater possibility for investors to move their money into stocks → Greater stimulation of the economy

The Risks:

RISK #1: Inflation

The Fed purchased these bonds by printing 600 billion dollars. Increasing the money supply runs the risk of higher inflation rates. (Why? A fundamental rule of economics is that the greater the supply of a product, the less its value. The same is true with currency. So the more supply of dollars, the less its value, meaning the more dollars it will take to purchase the same amount of goods, i.e. inflation.)

1. If inflation occurs, consumers will have to pay more dollars to purchase the same amount of goods.

2. Lenders become more restrictive in providing credit. Since fixed-rate loans are not adjusted for inflation, the payments a lender receives from the payee in the future will effectively be worth less and less. For example, if a lender provides credit at a 3% annual interest rate in an environment with 5% rate of inflation, the $500 a lender would receive next year would be worth less than $500 in the present, so why lend at all? If credit tightens, the economy may dip back into recession.

3. Inflation may not be uniform across all sectors. If inflation rates have a greater influence on the prices of oil and other imported commodities, it would be a boon for exporters overseas but, in turn, hurt many U.S. businesses.

Reason to take Risk #1: Greater Cushion

The Fed targets a 2% annual rate of inflation. This number, they believe, is one that reflects that the economy is moving forward at a reasonable pace. In the last eight months, however, the rate of inflation was only barely above 1%. This current low rate of inflation mitigates some of the very real risk of higher inflation.

More Reason(s) to take Risk #1: Inflation Good

1. Stimulates economy today - Just the anticipation of higher rates of inflation in the future drives greater demand today. If people believe that a new couch will be 5% higher next year, they will presumptively take out a loan with say 3% interest and choose to purchase the couch now. (Thought to consider: Do most people really think about this when they make their purchases? This reasoning may be sound in theory, but not in reality.)

2. Good for Borrowers - Makes it easier for consumers to pay off existing debt on fixed-rate loans. Higher inflation typically translates into higher wages. Since fixed-rate loans are not adjusted to the rate of inflation, the rate will stay the same as a consumer’s wages increase. (The opposite is the reason for why deflation is a problem – makes it harder for consumers to pay off fixed-rate loans.)

RISK #2: International Consequences

1. Devaluation Wars

China has been artificially deflating its currency in an effort to run trade surpluses. China pegs its currency to the dollar, ensuring that Chinese goods would be cheaper to purchase no matter how strong or weak the dollar becomes. The U.S. has been critical of China’s currency manipulation as the cause for the U.S. soaring trade deficits.

I think it's important to inform you of Currency Pegs. For this, we'll insert another Patty Hirsch video...

Now China hurls the same argument at the Fed. With an additional $600 billion "printed", the dollar is expected to get weaker, allowing some U.S. goods to be more competitive abroad and, in turn, reducing the trade deficit. Good for the U.S., not good for China.

To remain competitive, other monetary institutions may attempt to manipulate their respective currencies toward devaluation as well. So we may see widespread currency devaluations, leading toward greater instability in the currency markets.

2. Loss of Foreign Purchasers of U.S. Debt

China purchases and holds trillions of dollars of U.S. debt. It wants assurances that the dollar does not devalue too significantly, or else its holdings would devalue significantly as well. Since it was unable to dissuade the Fed from its quantitative easing initiative that may lead to the dollar’s devaluation, China and other foreign purchaser may abstain from further purchases of U.S. debt. If this happens, Treasury markets may suffer, leading to higher interest rates and inflation.

Many thanks to Shawn for his input.

Next up, I will attempt to explain Quantitative Easing and the Phillip's Curve.

The Problem:

The U.S. economy is currently sputtering along, hovering at high unemployment (almost 10%), and facing a possible risk of deflation. Core inflation (which excludes volatile food and energy prices) is currently at .06 percent, the lowest ever on record.

The Fed’s Solution:

The Fed will purchase $600 billion worth of U.S. Treasury bonds (2 year/10 year/30 year bonds) over the following months, adjusting the amount after each set of purchases according to the economic response.

Why?

The Fed’s main goal right now is to invigorate the economy, but its intention is hampered by investors who park their capital in U.S. Treasury bonds instead of investing it in riskier assets like stocks.

To incentivize these players to move their money into stocks, the Fed must reduce the appeal of U.S. Treasury bonds.

Their Plan:

Buy billions of dollars worth of U.S. Treasury bonds → Lowers the U.S. Treasury bonds’ interest rates → Creates less demand for these bonds → Greater possibility for investors to move their money into stocks → Greater stimulation of the economy

The Risks:

RISK #1: Inflation

The Fed purchased these bonds by printing 600 billion dollars. Increasing the money supply runs the risk of higher inflation rates. (Why? A fundamental rule of economics is that the greater the supply of a product, the less its value. The same is true with currency. So the more supply of dollars, the less its value, meaning the more dollars it will take to purchase the same amount of goods, i.e. inflation.)

1. If inflation occurs, consumers will have to pay more dollars to purchase the same amount of goods.

2. Lenders become more restrictive in providing credit. Since fixed-rate loans are not adjusted for inflation, the payments a lender receives from the payee in the future will effectively be worth less and less. For example, if a lender provides credit at a 3% annual interest rate in an environment with 5% rate of inflation, the $500 a lender would receive next year would be worth less than $500 in the present, so why lend at all? If credit tightens, the economy may dip back into recession.

3. Inflation may not be uniform across all sectors. If inflation rates have a greater influence on the prices of oil and other imported commodities, it would be a boon for exporters overseas but, in turn, hurt many U.S. businesses.

Reason to take Risk #1: Greater Cushion

The Fed targets a 2% annual rate of inflation. This number, they believe, is one that reflects that the economy is moving forward at a reasonable pace. In the last eight months, however, the rate of inflation was only barely above 1%. This current low rate of inflation mitigates some of the very real risk of higher inflation.

More Reason(s) to take Risk #1: Inflation Good

1. Stimulates economy today - Just the anticipation of higher rates of inflation in the future drives greater demand today. If people believe that a new couch will be 5% higher next year, they will presumptively take out a loan with say 3% interest and choose to purchase the couch now. (Thought to consider: Do most people really think about this when they make their purchases? This reasoning may be sound in theory, but not in reality.)

2. Good for Borrowers - Makes it easier for consumers to pay off existing debt on fixed-rate loans. Higher inflation typically translates into higher wages. Since fixed-rate loans are not adjusted to the rate of inflation, the rate will stay the same as a consumer’s wages increase. (The opposite is the reason for why deflation is a problem – makes it harder for consumers to pay off fixed-rate loans.)

RISK #2: International Consequences

1. Devaluation Wars

China has been artificially deflating its currency in an effort to run trade surpluses. China pegs its currency to the dollar, ensuring that Chinese goods would be cheaper to purchase no matter how strong or weak the dollar becomes. The U.S. has been critical of China’s currency manipulation as the cause for the U.S. soaring trade deficits.

I think it's important to inform you of Currency Pegs. For this, we'll insert another Patty Hirsch video...

Now China hurls the same argument at the Fed. With an additional $600 billion "printed", the dollar is expected to get weaker, allowing some U.S. goods to be more competitive abroad and, in turn, reducing the trade deficit. Good for the U.S., not good for China.

To remain competitive, other monetary institutions may attempt to manipulate their respective currencies toward devaluation as well. So we may see widespread currency devaluations, leading toward greater instability in the currency markets.

2. Loss of Foreign Purchasers of U.S. Debt

China purchases and holds trillions of dollars of U.S. debt. It wants assurances that the dollar does not devalue too significantly, or else its holdings would devalue significantly as well. Since it was unable to dissuade the Fed from its quantitative easing initiative that may lead to the dollar’s devaluation, China and other foreign purchaser may abstain from further purchases of U.S. debt. If this happens, Treasury markets may suffer, leading to higher interest rates and inflation.

Many thanks to Shawn for his input.

Next up, I will attempt to explain Quantitative Easing and the Phillip's Curve.

Wednesday, November 17, 2010

A Cartoon on Quantitative Easing

I saw this on CNBC today and it is PURE GENIUS!

*I now await responses from Shawn, Brad and Anil...

*I now await responses from Shawn, Brad and Anil...

Friday, November 5, 2010

The End of the Housing Bust and more Quantitative Easing

NPR's Planet Money had an excellent podcast about the End of the Housing Bust (say whaaaaa?!).

They have also translated the Fed's announcement of more Quantitative Easing...

The economy still sucks. People are spending a little bit more, but they're stretched thin: One in 10 workers can't find a job, wages are basically flat, home prices are way down and nobody can get a loan. Companies are buying more stuff, for now, but they're not building new factories or offices. Nobody's hiring. Nobody's building. Inflation has gone from low to super low.

The Fed has two main jobs: Keep unemployment low and prices stable. At the moment, as you may have heard, unemployment is really high. And inflation is so low that it's making us nervous. We keep saying that unemployment's going to fall. And it keeps not falling.

So to give the economy a kick in the ass—and to pump up inflation a little bit—we decided to go on a shopping spree. First of all, we're going to keep buying new stuff when our old investments pay off. Second—and this is the big news for today—we're going to create $600 billion out of thin air and use it over the next eight months to buy bonds from the federal government. We hope this will make interest rates go so low that people will borrow and spend more money, and companies will start hiring. By the way, this is an experiment, and we don't really know how it's going to work out. We reserve the right to change our plans at any time.

They have also translated the Fed's announcement of more Quantitative Easing...

The economy still sucks. People are spending a little bit more, but they're stretched thin: One in 10 workers can't find a job, wages are basically flat, home prices are way down and nobody can get a loan. Companies are buying more stuff, for now, but they're not building new factories or offices. Nobody's hiring. Nobody's building. Inflation has gone from low to super low.

The Fed has two main jobs: Keep unemployment low and prices stable. At the moment, as you may have heard, unemployment is really high. And inflation is so low that it's making us nervous. We keep saying that unemployment's going to fall. And it keeps not falling.

So to give the economy a kick in the ass—and to pump up inflation a little bit—we decided to go on a shopping spree. First of all, we're going to keep buying new stuff when our old investments pay off. Second—and this is the big news for today—we're going to create $600 billion out of thin air and use it over the next eight months to buy bonds from the federal government. We hope this will make interest rates go so low that people will borrow and spend more money, and companies will start hiring. By the way, this is an experiment, and we don't really know how it's going to work out. We reserve the right to change our plans at any time.

Tuesday, November 2, 2010

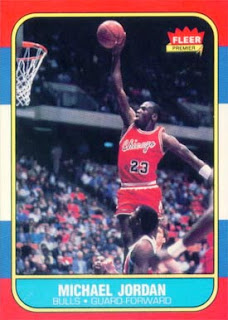

The Michael Jordan Rookie Card - A Worthy Investment? Or an Illusion?

I met with some friends last night for dinner and during our conversation, the topic of investments briefly came up. My friend, Jon and I can talk for hours about business, investments, the markets, et al but this particular investment conversation focused around the usual things but then transitioned into something else:

the Fleer 1986-87 Michael Jordan Rookie Card.

Look. At. It.

Jordan rising above the competition, arm stretched, tongue out - it is the rookie card that measures all other rookie cards. I don't think anyone has such a perfect rookie card (ok, maybe Joe Montana has a good one). The irony is that Jordan was already two years into his NBA career yet, the Fleer Michael Jordan RC is the standard.

But from an investor's point of view, I want to know that I'm going to receive a return. Sure, there's sentimental value of buying this card but what I think its worth may not be what another person thinks it's worth.

Therein lays the problem. There's no real way to perform valuation on a Michael Jordan rookie card. It doesn't pay derivatives, it doesn't have returns, you can’t reasonably forecast what the card will be worth in 5,10 or 20 years. I can’t track the price of the card over the past 20 years to even estimate what type of return it would bring. Another problem is; I don't know where to start. This isn't like stocks which I can compare to an index, review financial statements, perform value investing algorithms.

This is something different.

My mind started to think about this (insert Wayne's World Dream sequence here)...

- We’ve reached the peak of Jordan's rookie card value - he's already in the hall of fame. He has his championships, endorsements, shoes, brand, etc.

- I won’t be able to sell it (I would have to list it on ebay, Craigslist or attend Card Collector Conventions and although all of these markets are relatively easy to enter, the most important factors in markets is buyers and sellers and in tough economic times, the card will NOT sell)

- It’s a bubble

To cater my assumptions, I hit-up a local card shop on South Wacker during my work-break (that’s how dedicated I am). This small, 15 foot by 15 foot room was tucked away in Jeweler’s Row. The nice man hovers over his collection case mixed with coins, autographs, magazines and cards. He’s wearing a black sport coat and is wearing a gold rolex (which I noticed immediately). As I talked to the nice man about the Jordan RC, he distinctly tells me three things:

- The Jordan RC is overpriced. So much so that he does not even carry one (yes, I asked). And even if he did, he wouldn’t be able to sell it (see; Financial Crisis of 2007-2010).

- Jordan’s card peaked a couple years ago and it has nowhere else to go but down.

- Because of the lack of demand, the stringent authentication process, the declining value, the flooded market of fakes, the Jordan RC is worth essentially…nothing.

(I was quite surprised by the man’s forthright honesty. I mean, he didn’t have to tell me anything. After all, I bought nothing. He didn’t have to answer my questions but yet he did…this says a lot about a person’s character)

Like all assets, there MUST be buyers and sellers. And when there’s no buyers, your asset sits and depreciates…to nothing. The Jordan rookie card is no different. Even in Chi-City, Jordan can’t outplay the recession.

Do I think Jordan’s RC is worth $1500? After this excursion, absolutely not. But it’s still priced around that range. That leads me to believe that people’s sentimental and emotional attachment of the greatest player of all time could be having an effect on the price.

The lesson in all of this is to leave your emotional and sentimental feelings at the door.

This is money.

Real dollars.

But sometimes it’s hard to walk away. Hell, even MJ thought so.

Labels:

Air Jordans,

Chicago Bulls,

Fleer,

Joe Montana,

Michael Jordan

Sunday, October 31, 2010

Insider Trading and 911

I'm not one for conspiracy theories but there's something to this.

Pre-9/11 Put Options on Companies Hurt by Attack Indicates Foreknowledge | 911 Research.

Financial transactions in the days before the attack suggest that certain individuals used foreknowledge of the attack to reap huge profits.

"You follow drugs, you get drug addicts and drug dealers. But you start to follow the money... and you don't know where the fuck it is going to take you." - Det. Lester Freamon, The Wire

Pre-9/11 Put Options on Companies Hurt by Attack Indicates Foreknowledge | 911 Research.

Financial transactions in the days before the attack suggest that certain individuals used foreknowledge of the attack to reap huge profits.

"You follow drugs, you get drug addicts and drug dealers. But you start to follow the money... and you don't know where the fuck it is going to take you." - Det. Lester Freamon, The Wire

Labels:

911,

Conspiracy,

Insider Trading,

Lester Freamon,

Put Options,

The Wire

Sunday, October 24, 2010

The Great American Bubble Machine

Rolling Stone columnist, Matt Taibbi explaining how Goldman Sachs is behind every major market bubble since the Great Depression. His original article can be read here.

You can follow Matt on his blog Taibblog.

Part 1

Part 2

Part 3

Part 4

Part 5

You can follow Matt on his blog Taibblog.

Part 1

Part 2

Part 3

Part 4

Part 5

Thursday, October 21, 2010

Payday Lending

I'm always shocked at the amount of Payday lending vendors around the City of Chicago. If I drive one block south to Roosevelt or a couple blocks west to Damen, I start to see the infestation of payday lending.

The 411 on Payday Lending:

- Payday lending is legal and regulated in 37 states

- In 13 states it is either illegal or not feasible, given state law

- 23,000 lenders

- $40 billion industry

- Typical borrower takes out between eight and 10 loans each year

“Payday lenders contend that they provide access to credit for underserved communities,” said Leslie Parrish, a senior researcher at the Center for Responsible Lending. “What they are really providing is access to long-term debt traps which too often lead to extra overdraft fees, credit card delinquency, trouble paying bills including medical expenses, even bankruptcy." (Louisiana Weekly)

The Center for Responsible Lending (yes, you should be familiar with them) explains how payday lending works.

In May, the crew at Planet Money made a podcast about payday lending...check it out.

Additional Reading:

Costly Cash: The Great Recession Is Paying Off for Pawnshops and Payday Lenders

Labels:

Chicago,

Lotto,

Payday Loans

Tuesday, October 19, 2010

Uncle Ben goes shopping

In September I posted a video about Quantitative Easing from Patty Hirsch at Marketplace.org. This is a good follow up to that video.

"The Federal Reserve is trying to stimulate the economy by buying billions of dollars worth of bonds from banks. Senior Editor Paddy Hirsch explains how that's supposed to work."

"The Federal Reserve is trying to stimulate the economy by buying billions of dollars worth of bonds from banks. Senior Editor Paddy Hirsch explains how that's supposed to work."

Labels:

Ben Bernanke,

Marketplace,

Paddy Hirsch,

Quantitative Easing

Friday, October 15, 2010

Rich Whitney and Election Rigging in Illinois

We've had the voting/electoral system in this country for hundreds of years. Yet, we cannot get a candidate's name spelled correctly. I do not think this is an egregious error - but election rigging. Politics is a dirty game in Illinois and unfortunately for Rich Whitney (G-Carbondale), when you decisively win a debate about economics against the two favored candidates (Governor Pat Quinn (D-Chicago) and Bill Brady (R-Bloomington), this is what happens:

"(Springfield, IL) -- An Illinois Green Party gubernatorial candidate is unhappy with the Chicago Board of Elections. That's because Rich Whitney's name is misspelled as Rich Whitey on electronic-voting machines. The problem shows up in more than 20 wards, half of them in mostly African-American areas. Officials acknowledged earlier this week that there's not enough time to get the problem corrected by election day.

They added that about 90-percent of votes will be cast on paper ballots, where Whitney's name is spelled correctly." (mystateline.com)

Seriously, how can you explain this?

"(Springfield, IL) -- An Illinois Green Party gubernatorial candidate is unhappy with the Chicago Board of Elections. That's because Rich Whitney's name is misspelled as Rich Whitey on electronic-voting machines. The problem shows up in more than 20 wards, half of them in mostly African-American areas. Officials acknowledged earlier this week that there's not enough time to get the problem corrected by election day.

They added that about 90-percent of votes will be cast on paper ballots, where Whitney's name is spelled correctly." (mystateline.com)

Seriously, how can you explain this?

Thursday, October 14, 2010

Financial Illiteracy in America

We have a problem in America. That problem being that so many Americans do not know the fundamentals of finance (personal or otherwise).

Here's some links regarding Financial Illiteracy.

Here's some links regarding Financial Illiteracy.

- Drew Brees of the New Orleans Saints wrote this about financial literacy.

- Author, John Hope Bryant expressed the problems with financial illiteracy as well as some ideas on how to fight the war on financial literacy Financial Literacy as the New Civil Right: Why It Matters to Business in America

- Greater Fools | The New Yorker

- America's Financial Illiteracy | Forbes

- Even the Government has stepped in by signing into law the Dodd-Frank Wall Street Reform and Consumer Protection Act. Although it doesn't mention Financial Literacy verbatim, evaluating credit and lending practices, permanently increasing protection of bank deposits, providing more transparency and accountability for investments and related services, addressing risky banking practices, and monitoring systemic risk is a SOLID step in the right direction.

Wednesday, October 13, 2010

Two Housing Articles You Should Read

Global House Prices: Unsafe as Houses - An interactive overview of global prices and rents (as a BONUS it allows you to compare house price indicators in 21 markets).

"The interactive tool above enables you to compare nominal and real house prices across 21 markets over time. And to get a sense of whether buying a property is becoming more or less affordable, you can also look at the changing relationships between house prices and rents, and between house prices and incomes." - The Economist

Realistic homeowners debunk the nest egg myth - Homeowners are realising that the proverbial housing ladder is not the route to financial security

"The interactive tool above enables you to compare nominal and real house prices across 21 markets over time. And to get a sense of whether buying a property is becoming more or less affordable, you can also look at the changing relationships between house prices and rents, and between house prices and incomes." - The Economist

Realistic homeowners debunk the nest egg myth - Homeowners are realising that the proverbial housing ladder is not the route to financial security

Tuesday, October 12, 2010

Wednesday, September 29, 2010

The Recession is Over?

Last week the National Bureau of Economic Research (NBER) said the recession ended in June 2009.

The NBER can say that the Recession ended over a year ago all they want but in the court of public opinion, the Recession isn't over.

Thankfully, Warren Buffet agreed and had this to say about the Recession.

What does Warren Buffet mean by all this GDP talk?

GDP represents the total dollar value of all goods and services produced over a specific time period. Some people look at GDP as output, others as measuring the size of the economy. It is compared year-to-year or quarter-to-quarter. If some economist somewhere (i.e.-Brad) says GDP is up 7%, it can be interpreted that the economy has grown by 7% over the last year (or past quarter).

What Warren is saying is that our GDP (our output, our income (income approach), our spending (expenditure approach)) needs to get back to pre-recession levels.

We're not there yet.

I like Warren's approach; combining it with unemployment and underemployment can make a strong case that we're still in a recession.

Debate on...

The NBER can say that the Recession ended over a year ago all they want but in the court of public opinion, the Recession isn't over.

Thankfully, Warren Buffet agreed and had this to say about the Recession.

What does Warren Buffet mean by all this GDP talk?

GDP represents the total dollar value of all goods and services produced over a specific time period. Some people look at GDP as output, others as measuring the size of the economy. It is compared year-to-year or quarter-to-quarter. If some economist somewhere (i.e.-Brad) says GDP is up 7%, it can be interpreted that the economy has grown by 7% over the last year (or past quarter).

What Warren is saying is that our GDP (our output, our income (income approach), our spending (expenditure approach)) needs to get back to pre-recession levels.

We're not there yet.

I like Warren's approach; combining it with unemployment and underemployment can make a strong case that we're still in a recession.

Debate on...

Labels:

expenditure approach,

GDP,

income approach,

nber,

Suckas,

underemployment,

unemployment,

warren buffet

Sunday, September 19, 2010

The Giant Pool of Money

The Giant Pool of Money | NPR

"A special program about the housing crisis produced in a special collaboration with NPR News. We explain it all to you. What does the housing crisis have to do with the turmoil on Wall Street? Why did banks make half-million dollar loans to people without jobs or income? And why is everyone talking so much about the 1930s?"

"A special program about the housing crisis produced in a special collaboration with NPR News. We explain it all to you. What does the housing crisis have to do with the turmoil on Wall Street? Why did banks make half-million dollar loans to people without jobs or income? And why is everyone talking so much about the 1930s?"

Thursday, September 9, 2010

Student Loans, Gateway Drug To Debt Slavery

Student Loans, Gateway Drug To Debt Slavery | The Consumerist

"One of the most important lessons students learn in college is how to get into debt and stay there. It's crucial to the success of the Republic. An indebted population is easier to control; needing to pay off crushing debt - a debt that if defaulted on has been stripped of many normal consumer protections and rights - graduates more willingly shuttle into cubicles, becoming the square pegs demanded by the square holes. After a few futile years of floundering idealism, their souls have been successfully jackbooted into powder and they're ready to keep the thumb on the next generation of would-be drones so as to protect their empire of matchsticks. But how did we get here? This chunky infographic examines the origins and (d)evolution of the student loan leviathan"

I have been talking about this for years. The student loan situation is out of control. Tuition costs are higher (even when America experienced one of the worst financial crises in history) and interest rates rose ON A GUARANTEED, RISK-FREE LOAN!!!

In addition, my friend found this GREAT Frontline story...

"One of the most important lessons students learn in college is how to get into debt and stay there. It's crucial to the success of the Republic. An indebted population is easier to control; needing to pay off crushing debt - a debt that if defaulted on has been stripped of many normal consumer protections and rights - graduates more willingly shuttle into cubicles, becoming the square pegs demanded by the square holes. After a few futile years of floundering idealism, their souls have been successfully jackbooted into powder and they're ready to keep the thumb on the next generation of would-be drones so as to protect their empire of matchsticks. But how did we get here? This chunky infographic examines the origins and (d)evolution of the student loan leviathan"

I have been talking about this for years. The student loan situation is out of control. Tuition costs are higher (even when America experienced one of the worst financial crises in history) and interest rates rose ON A GUARANTEED, RISK-FREE LOAN!!!

In addition, my friend found this GREAT Frontline story...

Tuesday, September 7, 2010

An Explanation in Video Form

!!! DISCLAIMER - I posted an article regarding Credit Default Swaps by Paddy Hirsch at Marketplace.org. I received great feedback regarding his explanation(s) and have decided to include his wonderful videos in this post...enjoy!

When I found Paddy Hirsch's video regarding Credit Default Swaps, I thought it was downright amazing. My colleague, Brad, had some solid feedback in his comment.

So I will attempt to tie-in Brad's comment and Paddy Hirsch's video(s)...

"CDOs (collateralized debt obligations) and repos (repurchase agreements) make up what economists call the "Shadow Banking System"...

CDO's

Repurchase Agreements

Shadow Banking

...this system allowed banks to become over-leveraged and overly-interconnected...

Leverage

Banks Interconnected

Thus, when the collateral in the CDOs -- in 2008, these were typically based in real-estate -- began to devalue, nearly every bank and financial institution imploded."

Numerous thoughts come to mind about this whole scenario. But the thought that sticks out the most is Hyman Minsky's Financial Instability Hypothesis which I have written about before (you can read it here).

I hope viewing Paddy Hirsch's videos coupled with Brad's comment (mixed with a shot of Hyman Minsky) explains this scenario well and doesn't leave you, badly, needing a drink.

;-)

When I found Paddy Hirsch's video regarding Credit Default Swaps, I thought it was downright amazing. My colleague, Brad, had some solid feedback in his comment.

So I will attempt to tie-in Brad's comment and Paddy Hirsch's video(s)...

"CDOs (collateralized debt obligations) and repos (repurchase agreements) make up what economists call the "Shadow Banking System"...

CDO's

Repurchase Agreements

Shadow Banking

...this system allowed banks to become over-leveraged and overly-interconnected...

Leverage

Banks Interconnected

Thus, when the collateral in the CDOs -- in 2008, these were typically based in real-estate -- began to devalue, nearly every bank and financial institution imploded."

Numerous thoughts come to mind about this whole scenario. But the thought that sticks out the most is Hyman Minsky's Financial Instability Hypothesis which I have written about before (you can read it here).

I hope viewing Paddy Hirsch's videos coupled with Brad's comment (mixed with a shot of Hyman Minsky) explains this scenario well and doesn't leave you, badly, needing a drink.

;-)

Sunday, September 5, 2010

How The Risk of a Double Dip Recession is Being Overblown

How The Risk of a Double Dip Recession is Being Overblown | F Wall Street

An excellent article from F Wall Street commentator (and value investor), Cale Smith. Written at the end of July, he has skepticism about a double-dip recession. Great read.

An excellent article from F Wall Street commentator (and value investor), Cale Smith. Written at the end of July, he has skepticism about a double-dip recession. Great read.

Labels:

Cale Smith,

Double-Dip Recession,

F Wall Street

Thursday, September 2, 2010

Quantitative Easing

Another GREAT explanation from Paddy Hirsch at Marketplace. This time he explains Quantitative Easing.

NPR's Planet Money had a podcast that discussed this type of process recently. Though they don't mention it [quantitative easing] by name, if you listen closely, it's there.

NPR's Planet Money had a podcast that discussed this type of process recently. Though they don't mention it [quantitative easing] by name, if you listen closely, it's there.

Labels:

Marketplace,

NPR,

Paddy Hirsch,

Planet Money,

Quantitative Easing

Sunday, August 29, 2010

Untangling Credit Default Swaps

Much thanks to my buddy Shawn for telling me about some excellent youtube videos regarding a confusing topic - credit default swaps (yay...drawings!).

Labels:

credit default swaps

Sunday, June 6, 2010

New York Lotto Commercial

I wrote about the lotto a couple months back (read it here). My friend Priya found this commercial for New York Lotto and I had to post it on the blog.

Friday, June 4, 2010

May Unemployment: The U-shaped Recession

The new unemployment numbers are out and again, The Census is responsible for 95% of the job growth in May (employers added 431,000 jobs in the month, Census hiring was responsible for 411,000).

The new unemployment numbers are out and again, The Census is responsible for 95% of the job growth in May (employers added 431,000 jobs in the month, Census hiring was responsible for 411,000). If we read between the lines, we see a job growth of 20,000. In the coming months, those 400K Census workers will be out of work and looking for new employment (full-time, part-time or otherwise).

I'm sensing a little bit of U-shaped recession here. Some of you may have sensed/seen it for months. But for some reason, I just visualized the unemployment numbers increasing when those census workers are unemployed again. This high(er) unemployment may stick around with marginal movement here or there until one

Looks like the 'U' in a U-shaped recession stands for unemployment.

Labels:

BLS,

Recession,

U-Shaped Recovery

Thursday, June 3, 2010

Winners take all in Rockonomics

Winners take all in Rockonomics | BBC

A little dated (circa 2006) but still relevant to the current situation going on in the music industry.

"Music itself is going to become like running water or electricity" - David Bowie

A little dated (circa 2006) but still relevant to the current situation going on in the music industry.

"Music itself is going to become like running water or electricity" - David Bowie

Wednesday, June 2, 2010

The Economics Of The Music Industry: A Band Has To Work Hard To Get Its Part

The Economics Of The Music Industry: A Band Has To Work Hard To Get Its Part | TechDirt

A couple weeks ago I hosted my ever popular discussion forum. One of the questions we discussed (ok-my question) was about the ever changing music industry. I've always been curious about the economics (dare I say-Rockonomics?) about the music industry. Partly because I'm a hobbyist guitar player and in a previous career I worked in radio.

A couple weeks ago I hosted my ever popular discussion forum. One of the questions we discussed (ok-my question) was about the ever changing music industry. I've always been curious about the economics (dare I say-Rockonomics?) about the music industry. Partly because I'm a hobbyist guitar player and in a previous career I worked in radio.

Friday, May 28, 2010

What is Leverage?

Leverage.

Leverage.We all have heard about it. But what is it?

To some, it's owning a significant amount of information that the other negotiating party involved doesn't have.

To others, it's a more financial based system where individuals and/or companies find borrowed funds for investment purposes.

A simple example of financial leverage:

Wednesday, May 26, 2010

Why Wall Street Is Recruiting Poker Players

Labels:

Poker,

Wall Street

Monday, May 24, 2010

Inside a Payday Loan Shop

Inside A Payday Loan Shop | Planet Money

A great podcast/read about Payday Loans, predatory lending from the Planet Money crew.

A great podcast/read about Payday Loans, predatory lending from the Planet Money crew.

Labels:

Payday Loans,

Planet Money,

Predatory Lending

Friday, May 21, 2010

Gambling with Other People's Money: How Perverted Incentives Created the Financial Crisis

Russ Roberts host of EconTalk, discusses his paper, "Gambling with Other People's Money: How Perverted Incentives Created the Financial Crisis." Roberts reflects on the past eighteen months of podcasts on the crisis, and then turns to his own take, a narrative that emphasizes the role of government rescues of creditors and the incentives this created for imprudent lending. He also discusses U.S. housing policy, particularly the Government Sponsored Enterprises (GSEs), Fannie Mae and Freddie Mac and how the government's implicit guarantee of lenders to the GSE's interacted with housing policy to increase housing prices. This in turn, Roberts argues, helped create the subprime market, created mainly by private investors. The episode closes with some of Roberts's doubts about his narrative.

You can find the podcast here.

You can find the podcast here.

Saturday, May 15, 2010

Chicago has a Problem and the Solution is to gouge its Citizens

Recently (in the past three days), two of my friends were the victims of questionable ticketing practices by the Chicago Police Department and Chicago Parking Authority.

Recently (in the past three days), two of my friends were the victims of questionable ticketing practices by the Chicago Police Department and Chicago Parking Authority. It is no secret that Chicago is facing a MASSIVE deficit ($525 million dollars) and must find new and creative ways to fill that deficit.

Apparently this means squeezing every last dime out of its citizens.

The Sun-Times wrote a good article about the declining revenues of parking tickets which can be found here.

Even our Aldermen speaking up about this issue...

"Aldermen said their constituents are fighting mad when it comes to parking and tickets. "I agree we are in a bad revenue situation," said Ald. Tom Allen, (38th Ward). "But I'm tired of us beating the daylights out of John Q. Citizen to get 50 bucks out of him because he overstayed his parking."

...

"At every community meeting, people are questioning us about the fact that we are attempting to collect more revenue from the tickets," said Ald. Freddrenna Lyle, (6th Ward)."

It is NOT the fault of the citizens of Chicago (or Illinois for that matter) for a deficit of epic proportions.

But unfortunately, it looks like we have to pay for it.

Additional Reading:

1.) Some 2009 stats on parking tickets

2.) Parking Tickets Up, Revenue Down

3.) The Expired Meter<--a parking ticket blog

4.) Traffic cameras billed as answer to Chicago's budget deficit

Saturday, April 24, 2010

Q & A: How can I be Recession Proof?

A couple weeks ago I reached out to my colleagues and friends and asked them to challenge me by sending questions regarding finance and/or economic issues that they were unsure about (I sis not receive any questions about the Cubs).

Their responses were many and varied:

1.)How can I be recession proof?

2.)What is leverage?

3.)What, if any, are the benefits of using credit?

4.)How does a country get into debt? Who is that debt owed to?

5.)How do people dodge taxes using off-shore bank accounts?

6.)How does money laundering work?

7.)What are the details of the SEC case against Goldman Sachs? Is Paulson just getting away? Are other investment banks soon to follow?

8.)What do I do with my tax return?

I will attempt to answer these questions.

So now I will start with Question 1:

HOW CAN I BE RECESSION PROOF?

Their responses were many and varied:

1.)How can I be recession proof?

2.)What is leverage?

3.)What, if any, are the benefits of using credit?

4.)How does a country get into debt? Who is that debt owed to?

5.)How do people dodge taxes using off-shore bank accounts?

6.)How does money laundering work?

7.)What are the details of the SEC case against Goldman Sachs? Is Paulson just getting away? Are other investment banks soon to follow?

8.)What do I do with my tax return?

I will attempt to answer these questions.

So now I will start with Question 1:

HOW CAN I BE RECESSION PROOF?

Sunday, April 11, 2010

Vinyl's Coming Back in a BIG Way

Music has been a big part of my life. My Father bought me my first guitar (which I wish I would've picked up when I was 8 instead of 22) and would play me records when I was a kid. Hell, one of my first gifts that I can remember as a kid is a Fisher Price record player that played 45s.

Music has been a big part of my life. My Father bought me my first guitar (which I wish I would've picked up when I was 8 instead of 22) and would play me records when I was a kid. Hell, one of my first gifts that I can remember as a kid is a Fisher Price record player that played 45s. Though I DESPISED being dragged to record stores when I was younger (this usually consisted of me pouting and throwing tantrums), it took me years to finally realize the significance of what he was trying to do: instill culture, rhythm, style, interest. All of these things are VITAL to success. My father wouldn't force his musical tastes on me, he just wanted me to believe in it; who or what band it may be didn't seem to matter to him.

Now it seems as if vinyl is coming back (this article is a GREAT read about the rebirth of vinyl as well as some sales numbers). So much so that there's a "holiday" called National Record Store Day (Saturday April 17th). I have taken a look at the list of artists that will be have released and concocted my own list of "nice to haves". Some of which I hope to get in an effort to start my own collection, others for friends, and maybe a couple to sell on a free market (there's the economics tie in).

So this weekend I will accompany my Father to celebrate National Record Store Day in Chicago. Some of these record stores I have been to many times before and I'm sure this trip will be reminiscent of days passed but with one exception-

I'll leave the tantrums at home.

Wednesday, April 7, 2010

Greenspan and Sex Panther

I was perusing the inter web and found this article about our former Chairman of the Fed, Alan Greenspan.

Greenspan is quoted as saying "When you've been in government for 21 years, as I have been, the issue of retrospect and what you should have done is a really futile activity," Greenspan said. "I was right 70% of the time. But I was wrong 30% of the time, and there were an awful lot of mistakes in 21 years," he added.

When I read the above underlined quote, I immediately thought of sex panther:

60% of the time, it works every time.

Greenspan is quoted as saying "When you've been in government for 21 years, as I have been, the issue of retrospect and what you should have done is a really futile activity," Greenspan said. "I was right 70% of the time. But I was wrong 30% of the time, and there were an awful lot of mistakes in 21 years," he added.

When I read the above underlined quote, I immediately thought of sex panther:

60% of the time, it works every time.

Labels:

ALAN GREENSPAN,

SEX PANTHER

A Random Thought on MBAs and Prestige Schools

Many MBA students complain that they will not land a high-paying gig because they do not attend Northwestern or University of Chicago...you know, those prestige schools, my response to that is this; does a square dancing violinist need a stradivarious?

If you have confidence, talent and passion, IT WILL SHOW.

Besides, does a recession care if your degree says Kellogg on it?

Labels:

MBA,

STRADIVARIOUS

Sunday, April 4, 2010

Job Growth and the Resilient Recovery

Ok-this article is everywhere and I dropped the ball and didn't post it a couple days ago.

March jobs report shows growth

(I've included snippets)

Growth should have an asterisk because although the Labor Department said the economy gained 162,000 jobs in the month, 48,000 of these were for the Census; meaning that they are TEMPORARY jobs.

The average time those unemployed have been out of a job now stands at just under eight months, a record-long duration.

Almost 1 million more have become so discouraged that they've stopped looking for work altogether and are no longer counted in the unemployment rate.

But the number of discouraged job seekers fell by just over 200,000 since February, an indication that job seekers are also sensing an improving market and are again looking for work.

There are still 9.1 million people working part-time jobs who want to be working full-time, up more than 250,000 since February.

In other news: it took me like 5 minutes to spell "asterisk" correctly.

March jobs report shows growth

(I've included snippets)

Growth should have an asterisk because although the Labor Department said the economy gained 162,000 jobs in the month, 48,000 of these were for the Census; meaning that they are TEMPORARY jobs.

The average time those unemployed have been out of a job now stands at just under eight months, a record-long duration.

Almost 1 million more have become so discouraged that they've stopped looking for work altogether and are no longer counted in the unemployment rate.

But the number of discouraged job seekers fell by just over 200,000 since February, an indication that job seekers are also sensing an improving market and are again looking for work.

There are still 9.1 million people working part-time jobs who want to be working full-time, up more than 250,000 since February.

In other news: it took me like 5 minutes to spell "asterisk" correctly.

Sunday, March 28, 2010

The Negative Saving Rate and the Age of Easy Credit

The Negative Saving Rate and the Age of Easy Credit | Get Rich Slowly

"The personal saving rate in the United States has been declining for years. In the 1970s and early 1980s, it frequently climbed above ten percent. More recently, it has hovered around zero. But the general trend is downward. Americans are not saving."

"The personal saving rate in the United States has been declining for years. In the 1970s and early 1980s, it frequently climbed above ten percent. More recently, it has hovered around zero. But the general trend is downward. Americans are not saving."

Saturday, March 27, 2010

I.O.U.S.A.

At the bottom of my blog, I have the National Debt. It is updated at a fast and furious pace. That number represents our liabilities. But what if I told you that that number is only a fraction of the overall debt? What about everything else (medicare, medicaid, etc, etc)?

Let's break down the numbers:

11,000,000,000,000 (Total Liabilities)

7,000,000,000,000 (unfunded promise of Social Security)

26,000,000,000,000 (unfunded promise of Medicare A,B)

8,000,000,000,000 (unfunded promise of Medicare D)

+ 1,000,000,000,000 (unfunded Misc Items)

__________________

53,000,000,000,000 Total

I just recently watched I.O.U.S.A. and have included the cliff notes (30 minute) version. If you watch one video from my blog, make it this one. This film boldly examines the rapidly growing national debt and its consequences for the United States and its citizens.

For more information on the organizations mentioned in the video, please visit the following:

-The Concord Coalition

-The Peter G. Peterson Foundation

Let's break down the numbers:

11,000,000,000,000 (Total Liabilities)

7,000,000,000,000 (unfunded promise of Social Security)

26,000,000,000,000 (unfunded promise of Medicare A,B)

8,000,000,000,000 (unfunded promise of Medicare D)

+ 1,000,000,000,000 (unfunded Misc Items)

__________________

53,000,000,000,000 Total

I just recently watched I.O.U.S.A. and have included the cliff notes (30 minute) version. If you watch one video from my blog, make it this one. This film boldly examines the rapidly growing national debt and its consequences for the United States and its citizens.

For more information on the organizations mentioned in the video, please visit the following:

-The Concord Coalition

-The Peter G. Peterson Foundation

Sunday, March 21, 2010

10 Places NOT to Use Your Debit Card

10 Places NOT to Use Your Debit Card | Yahoo

Debit cards have different protections and uses. Sometimes they're not the best choice.

Debit cards have different protections and uses. Sometimes they're not the best choice.

Saturday, March 20, 2010

A lesson in free markets: eBay

I was meandering through Best Buy the other day looking for the box set of The Wire and when I found it, I was taken back by the price.

$154.99 is a lot to pay, for anything.

So I immediately get on my iPhone and open the eBay app, type in "The Wire, box set" and look at the prices. Then it hit me; eBay is the perfect example of a free market. The buyer and seller exchange without much regulation/interference from government (though eBay does have some regulatory rules...but nothing too imposing), no tariffs imposed that favor one seller over another, no quotas on how much can be sold or restrictions on to whom. The seller can raise the price and list it as a "buy it now" option (if it is in high demand), or list it for the lower price and have the potential buyers bid.

Which brings me to my next point...

After the bidding is complete and the item sells for a specified price, that price is exactly what the product was worth to the market.

In this case, the box set of The Wire is not worth $154.99 to the market, it's actually worth $65-80 (this includes straight bidding and most "buy it now" options).

Ebay puts more buying power into the consumer's hands which is not a bad thing.

I paid $70 for my box set of The Wire and that includes free shipping.

More power to the consumer!

Additional Reading:

1.)Greg Perry wrote this about eBay and Free Markets...it's a good read (especially if you don't like Economic jargon).

2.)Adam Smith - the father of free markets.

$154.99 is a lot to pay, for anything.

So I immediately get on my iPhone and open the eBay app, type in "The Wire, box set" and look at the prices. Then it hit me; eBay is the perfect example of a free market. The buyer and seller exchange without much regulation/interference from government (though eBay does have some regulatory rules...but nothing too imposing), no tariffs imposed that favor one seller over another, no quotas on how much can be sold or restrictions on to whom. The seller can raise the price and list it as a "buy it now" option (if it is in high demand), or list it for the lower price and have the potential buyers bid.

Which brings me to my next point...

After the bidding is complete and the item sells for a specified price, that price is exactly what the product was worth to the market.

In this case, the box set of The Wire is not worth $154.99 to the market, it's actually worth $65-80 (this includes straight bidding and most "buy it now" options).

Ebay puts more buying power into the consumer's hands which is not a bad thing.

I paid $70 for my box set of The Wire and that includes free shipping.

More power to the consumer!

Additional Reading:

1.)Greg Perry wrote this about eBay and Free Markets...it's a good read (especially if you don't like Economic jargon).

2.)Adam Smith - the father of free markets.

Exploitation and The Lotto

One of my favorite songs of all time is "Big Poppa" by Notorious B.I.G. In this song there's a line

"Tremendous cream. Fuck a dollar and a dream."

Up the street from my apartment is a 7-Eleven and every time I walk into this store, there is a line of patrons from the register to the back of the store buying Lotto tickets. Some are picking their own numbers (birthdays, lucky numbers, same numbers, etc,etc), while others are anxiously waiting to get their quick picks.

All of these patrons have the same expressions; anxious, hopeless and tired. They are dreamers who can't wake up and who rely on random numbers to fix their situation.

I recently spoke to the manager of this 7-Eleven about what type of customers come in and purchase Lottery tickets and he told me the following:

"People come in here and spend $40-80 on lottery tickets. It's the same people; the uneducated, African-Americans, the poor, the elderly, the ones on welfare that need their money the most yet they are spending it on lotto tickets."

The criticism about the lottery is that state revenues from lotteries are drawn disproportionately from the more disadvantaged members of society. By disadvantaged I mean those with lower incomes, less formal education, blacks, and the aged.

Although the lottery does contribute, by Law, to the Common School Fund (Illinois students and schoolrooms receive nearly $623 million per year in Lottery revenue), skepticism remains.

“Lotteries are, in essence, a form of regressive taxation that distributes wealth and resources away from those who can least afford to pay...it extracts wealth from communities of color, and most particularly from African Americans.” said Paul Street, vice-president for research and planning at the Chicago Urban League.

But the lottery has created even more games to receive more revenue. During the recession, some state lottery sales have risen providing false hope to the unemployed/underemployed. Illinois has even seen its revenue stream of lottery sales rise during the recession.

Unfortunately this makes sense. When you're poor, broke and out of work it's easier to play the lotto with hopes of winning it big then taking control/ownership of your economic situation and doing something to improve it.

Maybe this is part of the human condition; taking the easy way out and hoping for a better tomorrow.

I'll walk into that 7-Eleven tomorrow and I'll see the same people lined up. They'll have the same expressions on their faces.

For some people, all they have is the dollar and a dream.

But I tend to side with Biggie on this one.

Some Statistics

a)You DO NOT have a greater chance at winning the lottery by playing the same numbers each time. Why? Basic randomness. The lottery is built off of randomness. People try to make a connection or see a pattern when there isn't any. You have the same odds at winning with your same numbers each week as the guy in front of you who has his quick picks.

b)You DO NOT increase your chances of winning by buying more tickets. Why? Because you increase the sample size when you do this when it only takes one ticket/combination to win. Having 50 tickets in your hand (and $50 less in your pocket) actually decreases your odds.

Additional articles:

1.)U.S. studies: poor, minorities most likely to play lottery often

2.)Where do Lottery profits go?

3.)‘Instant’ gratification: Illinois residents still buying lottery tickets

"Tremendous cream. Fuck a dollar and a dream."

Up the street from my apartment is a 7-Eleven and every time I walk into this store, there is a line of patrons from the register to the back of the store buying Lotto tickets. Some are picking their own numbers (birthdays, lucky numbers, same numbers, etc,etc), while others are anxiously waiting to get their quick picks.

All of these patrons have the same expressions; anxious, hopeless and tired. They are dreamers who can't wake up and who rely on random numbers to fix their situation.

I recently spoke to the manager of this 7-Eleven about what type of customers come in and purchase Lottery tickets and he told me the following:

"People come in here and spend $40-80 on lottery tickets. It's the same people; the uneducated, African-Americans, the poor, the elderly, the ones on welfare that need their money the most yet they are spending it on lotto tickets."

The criticism about the lottery is that state revenues from lotteries are drawn disproportionately from the more disadvantaged members of society. By disadvantaged I mean those with lower incomes, less formal education, blacks, and the aged.

Although the lottery does contribute, by Law, to the Common School Fund (Illinois students and schoolrooms receive nearly $623 million per year in Lottery revenue), skepticism remains.

“Lotteries are, in essence, a form of regressive taxation that distributes wealth and resources away from those who can least afford to pay...it extracts wealth from communities of color, and most particularly from African Americans.” said Paul Street, vice-president for research and planning at the Chicago Urban League.

But the lottery has created even more games to receive more revenue. During the recession, some state lottery sales have risen providing false hope to the unemployed/underemployed. Illinois has even seen its revenue stream of lottery sales rise during the recession.

Unfortunately this makes sense. When you're poor, broke and out of work it's easier to play the lotto with hopes of winning it big then taking control/ownership of your economic situation and doing something to improve it.

Maybe this is part of the human condition; taking the easy way out and hoping for a better tomorrow.

I'll walk into that 7-Eleven tomorrow and I'll see the same people lined up. They'll have the same expressions on their faces.

For some people, all they have is the dollar and a dream.

But I tend to side with Biggie on this one.

Some Statistics

a)You DO NOT have a greater chance at winning the lottery by playing the same numbers each time. Why? Basic randomness. The lottery is built off of randomness. People try to make a connection or see a pattern when there isn't any. You have the same odds at winning with your same numbers each week as the guy in front of you who has his quick picks.

b)You DO NOT increase your chances of winning by buying more tickets. Why? Because you increase the sample size when you do this when it only takes one ticket/combination to win. Having 50 tickets in your hand (and $50 less in your pocket) actually decreases your odds.

Additional articles:

1.)U.S. studies: poor, minorities most likely to play lottery often

2.)Where do Lottery profits go?

3.)‘Instant’ gratification: Illinois residents still buying lottery tickets

Wednesday, March 17, 2010

5 New Rules for a Healthy Credit Score

Thanks to my friend Bobby for sending me this article. I was going to just post a link but instead pasted the entire article (with a JUMP!).

-------------------------------

5 New Rules for a Healthy Credit Score

by Aleksandra Todorova

Tuesday, March 16, 2010

The rules that credit-card companies have to live by changed dramatically with the enactment of new regulations last month. Now, some of the rules for consumers striving to maintain good credit are changing, too.

For the most part, card holders would still do well to pay on time, keep their balances low and refrain from applying for too many credit cards at once. But some of the old tenets may not always hold up, as credit-card companies continue to adapt to the new environment and look for ways to run their for-profit businesses.

Case in point: Many issuers introduced annual or inactivity fees in the weeks leading to or immediately after the Credit Card Accountability, Responsibility and Disclosure Act went into effect. "Now folks have to decide -- do they want this card badly enough to pay the fee, or do they close it," says Barry Paperno, the consumer operations manager at FICO (FICO). It's a question of more than just losing a credit line. Closing a credit card can have a big impact on one's credit score. That is, unless you do some groundwork in advance.

With the help of some easy -- if often counterintuitive -- steps, you can improve and retain a healthy credit score even in today's fast-changing credit environment. Here are five:

-------------------------------

5 New Rules for a Healthy Credit Score

by Aleksandra Todorova

Tuesday, March 16, 2010

The rules that credit-card companies have to live by changed dramatically with the enactment of new regulations last month. Now, some of the rules for consumers striving to maintain good credit are changing, too.

For the most part, card holders would still do well to pay on time, keep their balances low and refrain from applying for too many credit cards at once. But some of the old tenets may not always hold up, as credit-card companies continue to adapt to the new environment and look for ways to run their for-profit businesses.

Case in point: Many issuers introduced annual or inactivity fees in the weeks leading to or immediately after the Credit Card Accountability, Responsibility and Disclosure Act went into effect. "Now folks have to decide -- do they want this card badly enough to pay the fee, or do they close it," says Barry Paperno, the consumer operations manager at FICO (FICO). It's a question of more than just losing a credit line. Closing a credit card can have a big impact on one's credit score. That is, unless you do some groundwork in advance.

With the help of some easy -- if often counterintuitive -- steps, you can improve and retain a healthy credit score even in today's fast-changing credit environment. Here are five:

Labels:

AnnualCreditReport.com,

CARD Act,

FICO,

Visa MasterCard

Friday, March 12, 2010

The Warning

FRONTLINE producer Michael Kirk unearths the hidden history of the nation's worst financial crisis since the Great Depression, explore...

"For those who haven't seen it, you can view a very excellent PBS documentary called "The Warning" that was broadcast this evening. You can watch it on the web here. It is the story of Brooksly Born (do a Google search if you are not familiar with her) who was the Commodities Futures Trading Commissioner in the Clinton administration. She first warned the public about the dangers of the unregulated OTC derivatives market and was ruthlessly silenced by powerful government officials and a host of congressmen who knew nothing about derivatives. Brooksly Born was far more intelligent and courageous than her opponents. 10 years later, as she predicted, the derivatives market brought down Bear Sterns, Lehman, and AIG and precipitated the ongoing financial crisis. The video is instructive and underscores the continued need for regulation of these as yet unregulated markets."-Felix, Morningstar forum

"For those who haven't seen it, you can view a very excellent PBS documentary called "The Warning" that was broadcast this evening. You can watch it on the web here. It is the story of Brooksly Born (do a Google search if you are not familiar with her) who was the Commodities Futures Trading Commissioner in the Clinton administration. She first warned the public about the dangers of the unregulated OTC derivatives market and was ruthlessly silenced by powerful government officials and a host of congressmen who knew nothing about derivatives. Brooksly Born was far more intelligent and courageous than her opponents. 10 years later, as she predicted, the derivatives market brought down Bear Sterns, Lehman, and AIG and precipitated the ongoing financial crisis. The video is instructive and underscores the continued need for regulation of these as yet unregulated markets."-Felix, Morningstar forum

Tuesday, March 9, 2010

A Review: Credit Karma

A friend recently referred me to Credit Karma. Don't worry-I did not hear of them either before this. I thought to myself "Self, great, another credit score company." But he caught my eye when he said

"...wanted to recommend Credit Karma, the website gives you free credit scores. Check it out..."

I admit, I still had some trepidation as I thought to myself "Self, great, another "FREE" credit score company."

But my friend is legit (meaning he's been in banking/finance all of his adult life, holds a Masters in Accounting, CPA, currently pursuing his CFA and he reads good books).

So I check it out. And surprisingly it is FREE!!!

One thing that impressed me with Credit Karma is that the signup was painless and it was relatively easy to use once logged in. Everything was pretty self-explanatory and I received my credit score (along with a nifty graph as soon as my homepage appeared). It kind of reminded me of Mint.

So after I received my credit score I immediately went to myFico and paid for my "actual" credit score and to no surprise, I found a slight variance between the two companies. But in the world of credit scores, a slight variance can cost you many dollars in higher interest rates. Another draw back is that it does not provide credit reports (which is absolutely pivotal to understand your past and present credit history).

I would recommend Credit Karma to anyone who are first-timers when reviewing their own personal credit information. But I would immediately follow that if they want to know ALL of their information, to just go with myFico.

All in all, I rate Credit Karma a 'B'. They showed up for class, did some homework and studied for a couple of tests.

"...wanted to recommend Credit Karma, the website gives you free credit scores. Check it out..."

I admit, I still had some trepidation as I thought to myself "Self, great, another "FREE" credit score company."

But my friend is legit (meaning he's been in banking/finance all of his adult life, holds a Masters in Accounting, CPA, currently pursuing his CFA and he reads good books).

So I check it out. And surprisingly it is FREE!!!

One thing that impressed me with Credit Karma is that the signup was painless and it was relatively easy to use once logged in. Everything was pretty self-explanatory and I received my credit score (along with a nifty graph as soon as my homepage appeared). It kind of reminded me of Mint.

So after I received my credit score I immediately went to myFico and paid for my "actual" credit score and to no surprise, I found a slight variance between the two companies. But in the world of credit scores, a slight variance can cost you many dollars in higher interest rates. Another draw back is that it does not provide credit reports (which is absolutely pivotal to understand your past and present credit history).

I would recommend Credit Karma to anyone who are first-timers when reviewing their own personal credit information. But I would immediately follow that if they want to know ALL of their information, to just go with myFico.

All in all, I rate Credit Karma a 'B'. They showed up for class, did some homework and studied for a couple of tests.

Wednesday, February 24, 2010

Thursday, February 18, 2010

When Owning Your Home Doesn't Pay

When Owning Your Home Doesn't Pay | Yahoo

Much thanks to my friend Bobby for finding this and supporting the blog.

Much thanks to my friend Bobby for finding this and supporting the blog.

Negative Net Worth

Negative Net Worth | Life in the Great Midwest

Wow-been awhile since I last posted. That's what happens when you have (more) law school applications, b-school and a job PLUS a good girlfriend that provides me the gravitational pull to keep me grounded...and sane.

Wow-been awhile since I last posted. That's what happens when you have (more) law school applications, b-school and a job PLUS a good girlfriend that provides me the gravitational pull to keep me grounded...and sane.

Thursday, January 28, 2010

Wednesday, January 20, 2010

The price of Pringles proves a potent predictor of a fair rate of exchange

The price of Pringles proves a potent predictor of a fair rate of exchange | Michigan Today

A brilliant piece on how a traveler used the price of Pringles to determine the exchange rate.

A brilliant piece on how a traveler used the price of Pringles to determine the exchange rate.

Tuesday, January 19, 2010

Economics and Annoying Smart Guys

Found this on YouTube and though a year or so old, I thought it was funny and worth putting on my blog.

Saturday, January 9, 2010

Podcast: John Maynard Keynes Has A Plan

Podcast: John Maynard Keynes Has A Plan | NPR: Planet Money

A great podcast from the Planet Money crew interviewing Keynes biographer, Lord Robert Skidelsky. His three-volume biography of Keynes is not only comprehensive (1000+ pages) -- it's also funny, insightful and frankly, a little raunchy.

Skidelsky has a new book about Keynes out, called Keynes: The Return of the Master.

A great podcast from the Planet Money crew interviewing Keynes biographer, Lord Robert Skidelsky. His three-volume biography of Keynes is not only comprehensive (1000+ pages) -- it's also funny, insightful and frankly, a little raunchy.

Skidelsky has a new book about Keynes out, called Keynes: The Return of the Master.

Friday, January 8, 2010

Unemployment Rate Unchanged for December 09

Unemployment remains unchanged at 10%. Here’s the unemployment rates (per month) for the year:

2009

January ............... 7.7

February .............. 8.2

March ................. 8.6

April ................. 8.9

May ................... 9.4

June .................. 9.5

July .................. 9.4

August ................ 9.7

September ............. 9.8

October ............... 10.2

November .............. 10.0

December .............. 10.0

I have to admit that this is kind of a shock…I was expecting this number to lower a tad to compensate workers landing jobs for the holidays. Which brings me to the UNDERemployment rate

Which increased to 17.4%

Underemployment rate is the unemployment rate + temporary workers (part-time, temp, intern, etc,etc), discouraged workers (people who leave the workforce altogether).

Some other notes from bls...

“Temporary help services added 47,000 jobs in December. Since reaching a low