This video will show you how to blow through $110 million dollars.

Monday, November 29, 2010

Wednesday, November 24, 2010

The Fed and Quantitative Easing: Necessity and Risks

I noticed that Patty Hirsch's video of Quantitative Easing has 73,000+ views. Brad and I have had some discussions about QE2 (the second round of Quantitative Easing) and I talked to another economist friend of mine (we'll call him Shawn) who was kind enough to write some thoughts about QE. I have posted below...

The Problem:

The U.S. economy is currently sputtering along, hovering at high unemployment (almost 10%), and facing a possible risk of deflation. Core inflation (which excludes volatile food and energy prices) is currently at .06 percent, the lowest ever on record.

The Fed’s Solution:

The Fed will purchase $600 billion worth of U.S. Treasury bonds (2 year/10 year/30 year bonds) over the following months, adjusting the amount after each set of purchases according to the economic response.

Why?

The Fed’s main goal right now is to invigorate the economy, but its intention is hampered by investors who park their capital in U.S. Treasury bonds instead of investing it in riskier assets like stocks.

To incentivize these players to move their money into stocks, the Fed must reduce the appeal of U.S. Treasury bonds.

Their Plan:

Buy billions of dollars worth of U.S. Treasury bonds → Lowers the U.S. Treasury bonds’ interest rates → Creates less demand for these bonds → Greater possibility for investors to move their money into stocks → Greater stimulation of the economy

The Risks:

RISK #1: Inflation

The Fed purchased these bonds by printing 600 billion dollars. Increasing the money supply runs the risk of higher inflation rates. (Why? A fundamental rule of economics is that the greater the supply of a product, the less its value. The same is true with currency. So the more supply of dollars, the less its value, meaning the more dollars it will take to purchase the same amount of goods, i.e. inflation.)

1. If inflation occurs, consumers will have to pay more dollars to purchase the same amount of goods.

2. Lenders become more restrictive in providing credit. Since fixed-rate loans are not adjusted for inflation, the payments a lender receives from the payee in the future will effectively be worth less and less. For example, if a lender provides credit at a 3% annual interest rate in an environment with 5% rate of inflation, the $500 a lender would receive next year would be worth less than $500 in the present, so why lend at all? If credit tightens, the economy may dip back into recession.

3. Inflation may not be uniform across all sectors. If inflation rates have a greater influence on the prices of oil and other imported commodities, it would be a boon for exporters overseas but, in turn, hurt many U.S. businesses.

Reason to take Risk #1: Greater Cushion

The Fed targets a 2% annual rate of inflation. This number, they believe, is one that reflects that the economy is moving forward at a reasonable pace. In the last eight months, however, the rate of inflation was only barely above 1%. This current low rate of inflation mitigates some of the very real risk of higher inflation.

More Reason(s) to take Risk #1: Inflation Good

1. Stimulates economy today - Just the anticipation of higher rates of inflation in the future drives greater demand today. If people believe that a new couch will be 5% higher next year, they will presumptively take out a loan with say 3% interest and choose to purchase the couch now. (Thought to consider: Do most people really think about this when they make their purchases? This reasoning may be sound in theory, but not in reality.)

2. Good for Borrowers - Makes it easier for consumers to pay off existing debt on fixed-rate loans. Higher inflation typically translates into higher wages. Since fixed-rate loans are not adjusted to the rate of inflation, the rate will stay the same as a consumer’s wages increase. (The opposite is the reason for why deflation is a problem – makes it harder for consumers to pay off fixed-rate loans.)

RISK #2: International Consequences

1. Devaluation Wars

China has been artificially deflating its currency in an effort to run trade surpluses. China pegs its currency to the dollar, ensuring that Chinese goods would be cheaper to purchase no matter how strong or weak the dollar becomes. The U.S. has been critical of China’s currency manipulation as the cause for the U.S. soaring trade deficits.

I think it's important to inform you of Currency Pegs. For this, we'll insert another Patty Hirsch video...

Now China hurls the same argument at the Fed. With an additional $600 billion "printed", the dollar is expected to get weaker, allowing some U.S. goods to be more competitive abroad and, in turn, reducing the trade deficit. Good for the U.S., not good for China.

To remain competitive, other monetary institutions may attempt to manipulate their respective currencies toward devaluation as well. So we may see widespread currency devaluations, leading toward greater instability in the currency markets.

2. Loss of Foreign Purchasers of U.S. Debt

China purchases and holds trillions of dollars of U.S. debt. It wants assurances that the dollar does not devalue too significantly, or else its holdings would devalue significantly as well. Since it was unable to dissuade the Fed from its quantitative easing initiative that may lead to the dollar’s devaluation, China and other foreign purchaser may abstain from further purchases of U.S. debt. If this happens, Treasury markets may suffer, leading to higher interest rates and inflation.

Many thanks to Shawn for his input.

Next up, I will attempt to explain Quantitative Easing and the Phillip's Curve.

The Problem:

The U.S. economy is currently sputtering along, hovering at high unemployment (almost 10%), and facing a possible risk of deflation. Core inflation (which excludes volatile food and energy prices) is currently at .06 percent, the lowest ever on record.

The Fed’s Solution:

The Fed will purchase $600 billion worth of U.S. Treasury bonds (2 year/10 year/30 year bonds) over the following months, adjusting the amount after each set of purchases according to the economic response.

Why?

The Fed’s main goal right now is to invigorate the economy, but its intention is hampered by investors who park their capital in U.S. Treasury bonds instead of investing it in riskier assets like stocks.

To incentivize these players to move their money into stocks, the Fed must reduce the appeal of U.S. Treasury bonds.

Their Plan:

Buy billions of dollars worth of U.S. Treasury bonds → Lowers the U.S. Treasury bonds’ interest rates → Creates less demand for these bonds → Greater possibility for investors to move their money into stocks → Greater stimulation of the economy

The Risks:

RISK #1: Inflation

The Fed purchased these bonds by printing 600 billion dollars. Increasing the money supply runs the risk of higher inflation rates. (Why? A fundamental rule of economics is that the greater the supply of a product, the less its value. The same is true with currency. So the more supply of dollars, the less its value, meaning the more dollars it will take to purchase the same amount of goods, i.e. inflation.)

1. If inflation occurs, consumers will have to pay more dollars to purchase the same amount of goods.

2. Lenders become more restrictive in providing credit. Since fixed-rate loans are not adjusted for inflation, the payments a lender receives from the payee in the future will effectively be worth less and less. For example, if a lender provides credit at a 3% annual interest rate in an environment with 5% rate of inflation, the $500 a lender would receive next year would be worth less than $500 in the present, so why lend at all? If credit tightens, the economy may dip back into recession.

3. Inflation may not be uniform across all sectors. If inflation rates have a greater influence on the prices of oil and other imported commodities, it would be a boon for exporters overseas but, in turn, hurt many U.S. businesses.

Reason to take Risk #1: Greater Cushion

The Fed targets a 2% annual rate of inflation. This number, they believe, is one that reflects that the economy is moving forward at a reasonable pace. In the last eight months, however, the rate of inflation was only barely above 1%. This current low rate of inflation mitigates some of the very real risk of higher inflation.

More Reason(s) to take Risk #1: Inflation Good

1. Stimulates economy today - Just the anticipation of higher rates of inflation in the future drives greater demand today. If people believe that a new couch will be 5% higher next year, they will presumptively take out a loan with say 3% interest and choose to purchase the couch now. (Thought to consider: Do most people really think about this when they make their purchases? This reasoning may be sound in theory, but not in reality.)

2. Good for Borrowers - Makes it easier for consumers to pay off existing debt on fixed-rate loans. Higher inflation typically translates into higher wages. Since fixed-rate loans are not adjusted to the rate of inflation, the rate will stay the same as a consumer’s wages increase. (The opposite is the reason for why deflation is a problem – makes it harder for consumers to pay off fixed-rate loans.)

RISK #2: International Consequences

1. Devaluation Wars

China has been artificially deflating its currency in an effort to run trade surpluses. China pegs its currency to the dollar, ensuring that Chinese goods would be cheaper to purchase no matter how strong or weak the dollar becomes. The U.S. has been critical of China’s currency manipulation as the cause for the U.S. soaring trade deficits.

I think it's important to inform you of Currency Pegs. For this, we'll insert another Patty Hirsch video...

Now China hurls the same argument at the Fed. With an additional $600 billion "printed", the dollar is expected to get weaker, allowing some U.S. goods to be more competitive abroad and, in turn, reducing the trade deficit. Good for the U.S., not good for China.

To remain competitive, other monetary institutions may attempt to manipulate their respective currencies toward devaluation as well. So we may see widespread currency devaluations, leading toward greater instability in the currency markets.

2. Loss of Foreign Purchasers of U.S. Debt

China purchases and holds trillions of dollars of U.S. debt. It wants assurances that the dollar does not devalue too significantly, or else its holdings would devalue significantly as well. Since it was unable to dissuade the Fed from its quantitative easing initiative that may lead to the dollar’s devaluation, China and other foreign purchaser may abstain from further purchases of U.S. debt. If this happens, Treasury markets may suffer, leading to higher interest rates and inflation.

Many thanks to Shawn for his input.

Next up, I will attempt to explain Quantitative Easing and the Phillip's Curve.

Wednesday, November 17, 2010

A Cartoon on Quantitative Easing

I saw this on CNBC today and it is PURE GENIUS!

*I now await responses from Shawn, Brad and Anil...

*I now await responses from Shawn, Brad and Anil...

Friday, November 5, 2010

The End of the Housing Bust and more Quantitative Easing

NPR's Planet Money had an excellent podcast about the End of the Housing Bust (say whaaaaa?!).

They have also translated the Fed's announcement of more Quantitative Easing...

The economy still sucks. People are spending a little bit more, but they're stretched thin: One in 10 workers can't find a job, wages are basically flat, home prices are way down and nobody can get a loan. Companies are buying more stuff, for now, but they're not building new factories or offices. Nobody's hiring. Nobody's building. Inflation has gone from low to super low.

The Fed has two main jobs: Keep unemployment low and prices stable. At the moment, as you may have heard, unemployment is really high. And inflation is so low that it's making us nervous. We keep saying that unemployment's going to fall. And it keeps not falling.

So to give the economy a kick in the ass—and to pump up inflation a little bit—we decided to go on a shopping spree. First of all, we're going to keep buying new stuff when our old investments pay off. Second—and this is the big news for today—we're going to create $600 billion out of thin air and use it over the next eight months to buy bonds from the federal government. We hope this will make interest rates go so low that people will borrow and spend more money, and companies will start hiring. By the way, this is an experiment, and we don't really know how it's going to work out. We reserve the right to change our plans at any time.

They have also translated the Fed's announcement of more Quantitative Easing...

The economy still sucks. People are spending a little bit more, but they're stretched thin: One in 10 workers can't find a job, wages are basically flat, home prices are way down and nobody can get a loan. Companies are buying more stuff, for now, but they're not building new factories or offices. Nobody's hiring. Nobody's building. Inflation has gone from low to super low.

The Fed has two main jobs: Keep unemployment low and prices stable. At the moment, as you may have heard, unemployment is really high. And inflation is so low that it's making us nervous. We keep saying that unemployment's going to fall. And it keeps not falling.

So to give the economy a kick in the ass—and to pump up inflation a little bit—we decided to go on a shopping spree. First of all, we're going to keep buying new stuff when our old investments pay off. Second—and this is the big news for today—we're going to create $600 billion out of thin air and use it over the next eight months to buy bonds from the federal government. We hope this will make interest rates go so low that people will borrow and spend more money, and companies will start hiring. By the way, this is an experiment, and we don't really know how it's going to work out. We reserve the right to change our plans at any time.

Tuesday, November 2, 2010

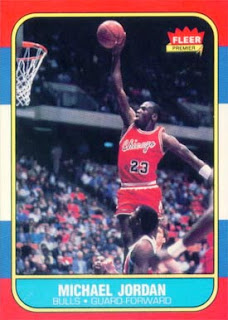

The Michael Jordan Rookie Card - A Worthy Investment? Or an Illusion?

I met with some friends last night for dinner and during our conversation, the topic of investments briefly came up. My friend, Jon and I can talk for hours about business, investments, the markets, et al but this particular investment conversation focused around the usual things but then transitioned into something else:

the Fleer 1986-87 Michael Jordan Rookie Card.

Look. At. It.

Jordan rising above the competition, arm stretched, tongue out - it is the rookie card that measures all other rookie cards. I don't think anyone has such a perfect rookie card (ok, maybe Joe Montana has a good one). The irony is that Jordan was already two years into his NBA career yet, the Fleer Michael Jordan RC is the standard.

But from an investor's point of view, I want to know that I'm going to receive a return. Sure, there's sentimental value of buying this card but what I think its worth may not be what another person thinks it's worth.

Therein lays the problem. There's no real way to perform valuation on a Michael Jordan rookie card. It doesn't pay derivatives, it doesn't have returns, you can’t reasonably forecast what the card will be worth in 5,10 or 20 years. I can’t track the price of the card over the past 20 years to even estimate what type of return it would bring. Another problem is; I don't know where to start. This isn't like stocks which I can compare to an index, review financial statements, perform value investing algorithms.

This is something different.

My mind started to think about this (insert Wayne's World Dream sequence here)...

- We’ve reached the peak of Jordan's rookie card value - he's already in the hall of fame. He has his championships, endorsements, shoes, brand, etc.

- I won’t be able to sell it (I would have to list it on ebay, Craigslist or attend Card Collector Conventions and although all of these markets are relatively easy to enter, the most important factors in markets is buyers and sellers and in tough economic times, the card will NOT sell)

- It’s a bubble

To cater my assumptions, I hit-up a local card shop on South Wacker during my work-break (that’s how dedicated I am). This small, 15 foot by 15 foot room was tucked away in Jeweler’s Row. The nice man hovers over his collection case mixed with coins, autographs, magazines and cards. He’s wearing a black sport coat and is wearing a gold rolex (which I noticed immediately). As I talked to the nice man about the Jordan RC, he distinctly tells me three things:

- The Jordan RC is overpriced. So much so that he does not even carry one (yes, I asked). And even if he did, he wouldn’t be able to sell it (see; Financial Crisis of 2007-2010).

- Jordan’s card peaked a couple years ago and it has nowhere else to go but down.

- Because of the lack of demand, the stringent authentication process, the declining value, the flooded market of fakes, the Jordan RC is worth essentially…nothing.

(I was quite surprised by the man’s forthright honesty. I mean, he didn’t have to tell me anything. After all, I bought nothing. He didn’t have to answer my questions but yet he did…this says a lot about a person’s character)

Like all assets, there MUST be buyers and sellers. And when there’s no buyers, your asset sits and depreciates…to nothing. The Jordan rookie card is no different. Even in Chi-City, Jordan can’t outplay the recession.

Do I think Jordan’s RC is worth $1500? After this excursion, absolutely not. But it’s still priced around that range. That leads me to believe that people’s sentimental and emotional attachment of the greatest player of all time could be having an effect on the price.

The lesson in all of this is to leave your emotional and sentimental feelings at the door.

This is money.

Real dollars.

But sometimes it’s hard to walk away. Hell, even MJ thought so.

Labels:

Air Jordans,

Chicago Bulls,

Fleer,

Joe Montana,

Michael Jordan

Subscribe to:

Posts (Atom)